AmpleFund - Sinking Fund & Saving Goal

AmpleFund - Sinking Fund & Saving Goal介绍

Sinking Fund (for Debt Prevention):

For personal finance, Sinking fund is money kept a side for a specific future use.

Sinking funds are typically for one year expense for example Income Tax or Property Tax or Festival like Christmas, which is going to come every year with more or less predictable amount required.

Sinking fund can be used for Emergency Fund or Medical Expense, in this case amount saving will be some multiplier of income or past expenses.

Sinking fund can also be used for long term expenses example new car or home buying (after several years) or education expenses. In such cases sinking fund can be invested as well.

AmpleFund Usage:

✓ Emergency Fund: Emergency Fund is one of very important Sinking Fund. There should be at least 3 month of income in Emergency Fund and it should be strictly be used for Emergencies.

✓ Car/Vehicle Maintenance: Most people face car/vehicle maintenance expense as surprise which breaks their budget. Create Sinking fund for this to avoid Maintenance surprises later.

✓ Birthday Gift/Celebration Fund: Gift and Celebration is one of the reason where your Monthly Budget will get impacted. But you can create Fund for this well in advance to spend on Gifting & Celebration.

✓ Travel Fund: Last time when you went for vacation, did you hated credit card statement that followed? Sinking fund for Travel is perfect way to avoid this. Create fund for you next dream vacation!

✓ Festival/Christmas Fund: Christmas comes every year and there is quite predictable expenses on Christmas. Create Christmas fund to avoid December being worst financial month!

✓ Property Tax / Income Tax Fund: Based on region/country Property Tax or Income Tax might be due once in a year, which usually comes as a surprise if not planned. Plan and create fund to avoid getting impacted by this.

✓ New Home/Car Down Payment Fund: Fund can be also created for future big expenses to avoid requiring to get into debt or at least reduce amount of debt requirement.

✓ Saving Goals: Fund can also be created to hold Saving for particular Goal. If goal is long term this fund can be invested for long term capital gain.

Above are some of example, however sinking fund can be created for any predictable future expense to avoid going into Debt.

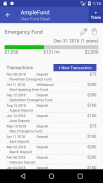

Fund Management:

Managing fund with AmpleFund is very easy:

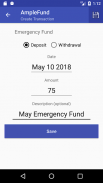

1. Create fund with target amount and date.

2. Add any Deposit or Withdrawal from Fund Detail screen.

3. Update Target Date and Amount every year for annual Funds.

4. Make sure to add Widgets to Home Screen. Widgets helps to keep track of Funds in Quick View.

AmpleFund Widgets:

Ample Fund Widgets are designed to give Quick View to track fund progress.

To add Widget go to your Home Screen with some empty space and long press. This will bring list of Widgets.

Select AmpleFund Widgets from the list and resize based on available space on Home Screen.

偿债基金(为防止债务):

对于个人理财,偿债基金的资金是保持一个侧面特定将来使用。

偿债基金通常为一年的费用,例如所得税和物业税或节如圣诞节,这是会每年都来与需要更多或更少的可预测量。

偿债基金可用于紧急基金或医疗费用,在这种情况下节省量将是收入或支出过去的一些乘数。

偿债基金,也可用于长期费用例如新汽车或家庭购买(经过几年)或教育费用。在这种情况下,偿债基金可以和投资。

AmpleFund用法:

✓应急基金:紧急基金是非常重要的偿债基金之一。应该有至少3个月的紧急基金的收入,它应该严格用于紧急情况。

✓汽车/汽车维修:大多数人面对汽车/汽车维修费用为神奇,这打破了他们的预算。建立偿债基金该以避免以后维护的惊喜。

✓生日礼品/同庆基金:礼品和庆典是在您的每月预算将获得影响的原因之一。但是你可以提前创建基金这口井对赠与和庆典花。

✓旅游基金:当你去度假,你讨厌的信用卡账单接下来是什么时候?偿债基金,用于旅游是为了避免这种完美的方式。为您的下一个梦想假期创建基金!

✓节/圣诞节基金:圣诞节来临时,每年并没有在圣诞节完全可预测的费用。创建圣诞节基金,以避免被十二月最严重的金融一个月!

✓物业税/所得税基金:基于区域/国家物业税或所得税可能会在一年内,它通常是作为一个惊喜,如果没有规划,一旦到期。规划和创建基金,以避免本入门的影响。

✓新首页/汽车预付款基金:基金可以为将来大的开销也创造了避免要求陷入债务,或者至少降低债务需要量。

✓降耗目标:基金还可以创建以保存储蓄特定目标。如果目标是长期本基金可以投资于长期的资本增值。

以上是一些例子,但是偿债基金可以为任何可预见的未来代价来避免陷入债务被创建。

基金管理:

与AmpleFund管理基金是很容易的:

1.创建目标金额和日期基金。

2.添加从基金的详细信息屏幕中的任何存款或提款。

3.更新目标日期和金额每年为年度基金。

4.确保窗口小部件添加到主屏幕。小工具可以帮助跟踪基金的快速查看。

AmpleFund小工具:

充足的基金小工具的目的是给快速查看追踪基金的进展。

要添加窗口小部件到您的主屏幕与一些空白区域,长按。这将使小工具的列表。

从列表中选择AmpleFund小工具和调整基于在主屏幕上的可用空间。